It is that time of year when companies big and small look to the New Year to see what it might hold. Hopefully it will involve growth, prosperity and progress for your business. But what if there was a way of removing that element of chance? Cash flow forecasting can give you just that - a look into the future.

Here are our 10 reasons for cash flow forecasting in 2015:

1. More power, less time consuming

Wouldn’t it be great if you didn’t have to spend loads of time poring over endless spreadsheets or waiting for your accountant to get back to you with an answer every time you wanted to know if something was possible? Of course the answer is yes!

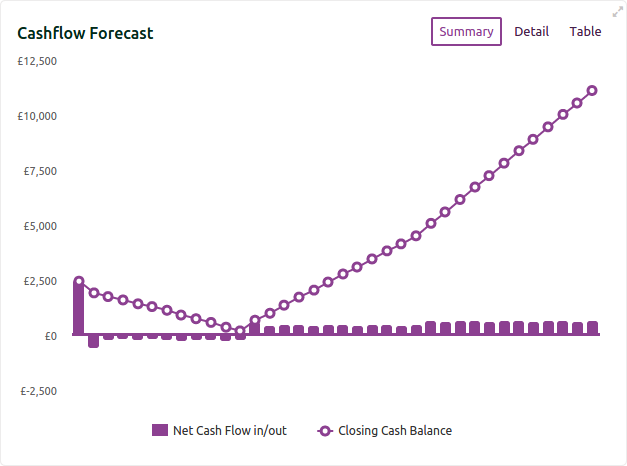

Cash flow forecasting gives you back control and could save a lot of time. Punching in the numbers and interpreting the generated graphs is so much quicker and easier than using spreadsheets - testing the equations, making sure the figures work, making sure every row is included in a calculation. Forecasting with Finanscapes takes away all the guess work.

2. Easy to see your options

Cash flow forecasting means you can visualise any and all of the scenarios you can think of for your business in 2015. Cash flow forecasting can give you the information you need to help you make those big decisions, including:

- taking on more staff,

- changing your prices

- tendering for a big contract,

- moving premises or

- changing suppliers.

You name it, cash flow forecasting is a vital part of your decision making process.

3. Removes the jeopardy

Risk is the biggest thing holding microbusinesses and SME’s back and this is where cash flow forecasting can really pay dividends.

With accurate forecasts to hand, you can see what the impact on your cash flow will be before you commit any money to a decision, significantly tilting the odds in your favour!

4. Better decision making

Simply put, cash flow forecasting, on a regular basis, gives you the knowledge you need to make better-informed decisions.

5. Growth planning

There are numerous ways a business can grow but which is right for your business? Cash flow forecasting can help you understand the different options and choose the one that fits your business. But it doesn’t end there…

Cash flow forecasting can be done at any stage of a process, so if you have committed to a growth strategy but something changes and you aren’t sure if you should continue pursuing it or not, stop and reforecast your new options.

6. Improves relationship management

One of the best ways to manage your cash flow is to have strong and flexible relationships with your suppliers because suppliers can cripple the cash flow of any business if they are mismanaged. Regular cash flow forecasting will help you to identify those suppliers that are crucial to your cash flow, giving you the opportunity to strengthen your relationship with them.

Equally, customer relationships are an integral part of cash flow and growth. Maintaining current customer relationships and implementing a culture of service and added value can reduce the turnover of customers and grow their loyalty. Try modelling a 15% increase in your customer re-purchase rate and see what effect that has on your cashflow!

7. Allows time to focus on other tasks

A significant advantage to cash flow forecasting in 2015 is that it is, with specific forecasting software, very easy and quick to use and interpret. With your key figures to hand you can have a graphical presentation of your cash flow forecast in front of you in minutes giving you the time and freedom to focus on other, more fun, tasks!

8. Can highlight potential problems

Cash flow forecasting will highlight any unforeseen problems with your cash flow giving you the time and information you need to steer your business clear of any problems before they occur.

This is particularly critical for microbusinesses and SME’s who may not have reserves of cash to fall back on if something goes wrong. Understanding the consequences of just some of the main problems which may occur can significantly reduce the impact they will have on your business - forewarned is forearmed!

You can’t always stop things out of your control from happening but if you know what the impact is on your business, you'll give it some consideration and will be in a better position to deal with it if the worst happens.

9. Builds investor confidence

With Finanscapes forecasting software, you can publish your forecasts to the bank or your funding manager to show you have made sufficient provision for the money you are requesting.

You can publish the different scenarios you have forecast to demonstrate your ability to manage their investment responsibility. Being able to demonstrate this level of fiscal responsibility can significantly increase the level of trust your investors place in you and your business.

10. Forecasting is much, much cheaper than failing

At the end of the day, we all hope 2015 will be more profitable than 2014 so avoid potential failure with regular cash flow forecasting and make provisions to improve your cash flow.

Growth requires cash so good cash flow management really is the key to a prosperous 2015.

About forecasting

Some (not all) accounting software has some basic cash flow forecasting built-in but Finanscapes is the only independent online software which makes the process simple, easy and painless. That's why the best accountants buy it to give to their clients. It gives you flexibility to forecast different scenarios, publish plans with confidence and allows you to play without the fear of affecting your live accounts - or your sanity!

You can try it for FREE now and see what the possibilities of 2015 are for you and your business.