1. Understand all of the variables

A successful cash flow forecast relies on you inputting all the necessary information which means it is essential you understand all of the fixed and variable income and outgoings that affect your cash flow.

There are numerous variables that affect cash flow and each of these need to be included in your cash flow forecast to give you an accurate forecast that you can rely on.

All of the variables that you will need to include in your cash flow forecast are covered in our post How to calculate cash flow.

2. Have all of your figures to hand

Once you have got your head around the different figures which need to be included in your cash flow forecast, we suggest you gather them all together before you start your forecast.

The reason for this is simple; some figures can take time to collate and if you start your cash flow forecast before you have everything to hand, you could get in a pickle. We have seen forecasts with figures entered twice (or missed out completely) because people have started them and returned to complete them at a later date, which has led to seriously inaccurate forecasts being produced!

Preparation is key to producing an accurate cash flow forecast so use our How to calculate cash flow post as a check list and gather all of your figures together before you start your cash flow forecast.

3. Use error-free technology (Not a spreadsheet!)

So, you have all of the information you need to hand and are ready to start your cash flow forecast…but how?

There are resources on the internet which will show you how to create a cash flow forecast using a spreadsheet but what they don’t tell you is how susceptible spreadsheets can be to human error.

As there are so many different variables and figures involved in creating a cash flow forecast, it is often necessary to add in additional columns or rows as you build your forecast. If you forget to update your formulae accordingly, your cash flow forecast will be inaccurate.

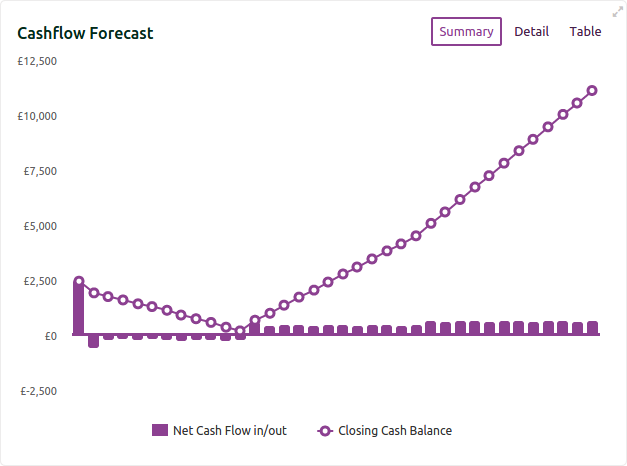

This is why we have developed our forecasting software which does all of the calculations and formulae for you. All you have to do is enter your figures in the step-by-step process and it will show you your cash flow forecast in your personalised dashboard.

You can then drill down into the figures or simply make decisions based on the graph it creates for you – it could be simpler! Start creating your cash flow forecast today – for FREE

4. Update your forecast regularly

For a cash flow forecast to be successful and useful, it needs to be updated on a regular basis. All forecasts are only as reliable as the information put into them.

We recommend updating your cash flow forecast figures on a quarterly basis, or more frequently if your business is changing and growing quickly.

For example, if you have recently expanded and taken on more staff, this will be having a direct impact on your cash flow so it is important to update your cash flow forecast figures to accurately represent this change.

Equally, if you change suppliers or have finished repaying some initial investment, your cash flow forecast will change so staying on top of all of these figures is an essential part of creating and using a successful cash flow forecast.

5. Set yourself targets

Once you have created your cash flow forecast and are in a routine of checking it and updating it on a regular basis, it is important to set your cash flow certain parameters within which to work to.

A good example is to set yourself a minimum cash flow threshold. This will ensure you are always in a positive cash flow situation and will have a buffer of cash from which to deal with any problems which may occur.

Another goal you may wish to set within your business is a maximum cash surplus which, when reached, indicates you have enough cash from which to reinvest or implement a growth strategy.

Setting these types of goals and targets means you are using your cash flow forecast to make informed business decisions and build a strong company.

6. Forecast the different scenarios

When it comes to making decisions within your business, it is useful to know what the likely outcome is going to be on your cash flow.

For example, if you are looking at taking on a big contract or tender you may need to know how many additional staff you can afford to take on or how much extra stock you are going to need to purchase up front. These decisions will hinge on your company’s cash flow and being able to forecast these different scenarios will tell show you what your options are.

It is much cheaper to forecast the options than to pay the consequences of not forecasting!

Try our cash flow forecasting tool today, for FREE, and see what your cash flow looks like in the future.