1. Top level view of the business

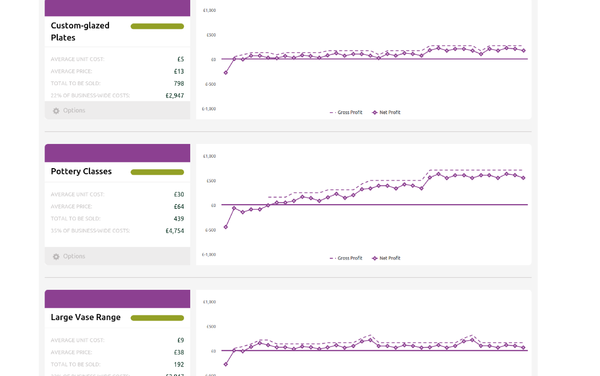

Forecasting software gives you a top level view of your company’s incomings and outgoings including your assets, liabilities, costs per product or service line and much more.

Finanscapes forecasting software will allow you to drill down into these top level numbers meaning you can choose whether you maintain an overview of your businesses financial health or drill down into the detailed figures.

2. Planning, planning, planning!

It is the most important part of running a successful business but you will struggle to plan any major parts of your business if you don’t know how and when you are able to fund these plans.

For example, you want to launch a new product line; can you afford to do so? Do you have the viable cash flow in the business or will you need to raise additional funds? If so, how much? And so on.

These questions are almost endless and only a regularly updated financial forecast will allow you to answer them.

3. Better decision making

Hand in hand with planning comes decision making. Whether you are required to make reactive decisions about circumstances outside of your control such as a key member of staff levelling, or you are making decisions about the future, you will need specific financial data to hand.

Finanscapes forecasting software has an intutive interface and dashboard which gives you the data you need, at the touch of a button, to make any and all important decisions within your business.

4. Foundations of your growth strategy

Looking to the future you want to see growth, who doesn’t. But putting a growth strategy in place starts with your financial forecast.

There are key questions you will need to have answers to when considering the different growth options for your business.

Depending on the options available to you, you are going to need to know what the cash flow forecast for your business looks like over a certain period of time in the future and what other financial factors can be modified in order to make the different growth strategies viable or not.

Understanding the impact variables such as cash flow, break even point and profit margins all have on your business, alongside other forecasted factors, will give you a clearer idea of the possible directions the growth of your business could take.

5. Investors require professional forecasting

There will be a time in most businesses when an injection of cash or funding is required, normally to facilitate growth. As part of the application process, your potential investors will want to see a robust and professional forecast to demonstrate your level of fiscal responsibility and the level of risk your investors will be taking.

One of the great advantages of Finanscapes forecasting software is that you can securely publish your forecasts to anyone you choose; investors, mentors and other stakeholders.

We have produced a video demonstrating how easy it is to securely publish your financial forecast.

6. Better disaster management

There will be times in every business when a potential disaster occurs, normally for reasons beyond your control such as the economic downturn or a change in employment legislation and so on.

However, this doesn’t have to spell disaster for your company; simply open your financial forecast and see which of your financial variables are affected and what this could mean for your business. There are likely to be a number of options you haven’t considered which could elevate the pressure these external factors have put on your business.

It might just be a case of changing supplier to ones with more favourable payment terms to improve cash flow or a reduction in staff hours meaning you could be operating, in the short term, more efficiently without a huge impact on production. Only your forecast will be able to tell you what your options are in a disaster and what impact they will have on the future of your business.

7. Better cash flow management

It stands to reason that if you are looking at the financial factors that affect your business on a day-to-day basis you are going to managing your cash flow in a more efficient way.

You will see, ahead of time, any cash flow issues which may occur and put remedial actions in place before the problem can take effect.

Looking at you forecast on a regular basis and making sure it is accurately maintained will ensure your cash flow remains healthy.

8. Reduces the risk of failure

Looking into the financial future of your business and making decisions based on your forecast data, you will be able to see any dangers coming and make plans to avoid them ahead of time.

This future-planning reduces the risk from your business considerably and increases your chances of success and growth.

9. Increases your success rate

If you add up all of the points above, I’m sure you can see how your business can benefit from using professionally developed forecasting software which allows you to better manage your business and circumnavigate problems before they occur.

The caveat for all of these points is that an inaccurate, over-estimated or ill-maintained forecast will not help you avoid risk or help your business grow.

Reduce the risk in your business with Finanscapes forecasting software.