Put simply, a cash flow forecast is a forward-looking view of the cash coming into and going out of your business. It will show you, at a glance, the amount of cash available in the business at any point. Notice we keep saying "cash" - that's money immediately available, on-hand or in the bank (so money customers owe you but haven't yet handed over doesn't count!).

Cash coming into your business comes, primarily, from sales. Cash going out of your business can include:

- Wages

- Supplies and suppliers

- Loan repayments

- Rent

- Insurance

- Business Rates

A cash flow forecast is a mapped-out view of the incoming and outgoing cash of your business each month over a fixed period of time – normally a year. If a business is struggling financially or is young with a limited amount of spare cash, more frequent cash flow forecasting may be required to keep a close eye on the situation - and a good tool to make this easier can pay for itself very quickly indeed.

Understanding cash flow forecasting, and why you need to start doing it, is integral to the successful management of your business - regardless of its size or turnover.

So why implement cash flow forecasting?

Interesting, but why do you need to know how much cash is in your business?

Well, the amount of cash in your business can have both short and long-term

implications:

- The firm’s growth plans

- The potential need for financial support

- The company’s ability to invest

- It's ability to simply pay the day-to-day expenses

- The amount of staff within the business

- The number of suppliers to the business

- The firm’s ability to save for future events

Looking at your annual cash flow forecast will show you how much cash there will be in the business each month, and if this number is expected to be high you can look at the different options. For example, saving some of it to finance your future growth plans or start implementing those growth plans immediately. Equally, additional cash in the business could be used to reward staff or loyal customers, or invest in replacement equipment or new premises. None of these decisions can be made without knowing how much cash is in your business and what the forecast is like for that cash.

It's not enough to believe your business will be profitable - profit isn't useful until it turns into cash!

On the other hand, your cash flow forecast could highlight potential problems on the horizon, especially if there is likely to be less cash in your business than you thought. Too small a cash buffer in your business could impact on your ability to pay your staff or make payments to suppliers - let alone make longer-term growth investments. Having very little cash in your business is a likely to be very stressful too - it's not good for anyone to be worrying about whether your can meet your obligations and pay your employees their salaries.

Regardless of what your cash flow forecast shows you, there will be operational and financial decisions to be made about within business. You will find it hard to make these managerial decisions without an accurate cash flow forecast.

What Does a Cash Flow Forecast Look Like?

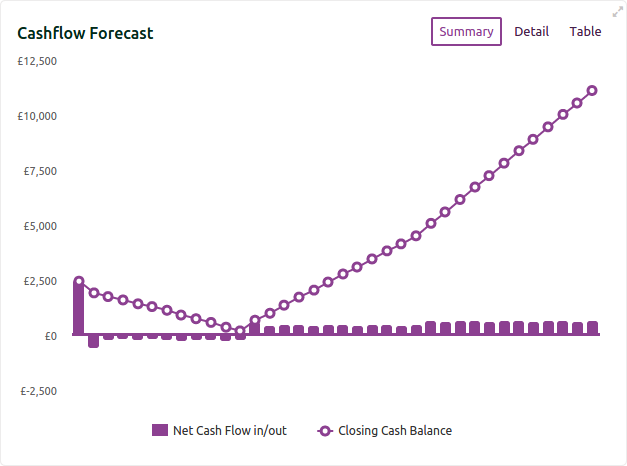

You don’t need complicated spreadsheets full of numbers and baffling, untestable formulas! Cash flow forecasts are easy to understand when you can see them visually in simple but powerful graphs such as the one below.

You can easily see at a glance whether your cash flow position is improving or decliining, the points where significant changes happen and the amount of cash flow within your business. With the help of a tool like this you can drill-down to see where the money is coming-from or going too - switching between graphs and tables, whichever suits you best.

It is important to remember that forecasting is only a prediction, based on the numbers you have put into the forecast. If these numbers are inflated or conservatively estimated, your cash flow forecast may be inaccurate. That's why it's important to use a straightforward process for capturing your information, so that your thinking is as free and easy as possible. Of course any estimates are subject to changing circumstances - so you should run several scenarios and review your actual position regularly against where you expected to be.

Other Reasons for Cash Flow Forecasting in your Business

The great benefit of forecasting is the ability to plan for different scenarios and situations before you commit to a decision. The economic and business worlds are far from certain and there are no guarantees, so planning for different eventualities is vital.

For example, if you forecast your cash flow based on your current (monthly) order book and outlays, you will know what cash you have in the business. However, what would your cash flow forecast look like if you lost your biggest customer? How big would the impact be? What are your options for recovering a healthy cash flow? What action could you take and what impact would the extra costs associated with it have on your business and cash flow? Scenario planning can help you answer these questions ahead of time and put you in a much stronger position.

Equally, if you have a number of potentially big contracts which may come to fruition in the coming months, what would that do to your cash flow? By forecasting it, you can see how your business might cope with a surge of cash. Would you invest it? Or save it? Or both? Would you need to take on extra staff - and extra costs? What does your cash flow forecast tell you about the consequences of these different options?

Planning and forecasting for such eventualities can seem quite scary but it doesn't need to be. It will allow you to put contingencies in place to ensure you are informed and prepared to make important managerial decisions in a timely fashion. This is a classic example of working on your business rather than working in it - and is what stands an entrepreneur apart from an employee.

So, next time someone asks you ‘What is a cash flow forecast?’ you will be able to answer them clearly and explain why it is so important to their business and financial management.

Questions?

If you have any questions about cash flow forecasting drop us a line. You can also follow us on Twitter or Google+ for all the latest financial forecasting news and best practise tips.